What Is Capital Gains Tax Rate 2022 . The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. — capital gains tax rates are the same in 2024 as they were in 2023: — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. When you realize a capital gain, the proceeds are considered taxable. — you earn a capital gain when you sell an investment or an asset for a profit. 0%, 15%, or 20%, depending on your income. The higher your income, the higher. what is the capital gains tax rate for 2022? — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets.

from topdollarinvestor.com

0%, 15%, or 20%, depending on your income. what is the capital gains tax rate for 2022? The higher your income, the higher. — capital gains tax rates are the same in 2024 as they were in 2023: The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets. — you earn a capital gain when you sell an investment or an asset for a profit. When you realize a capital gain, the proceeds are considered taxable.

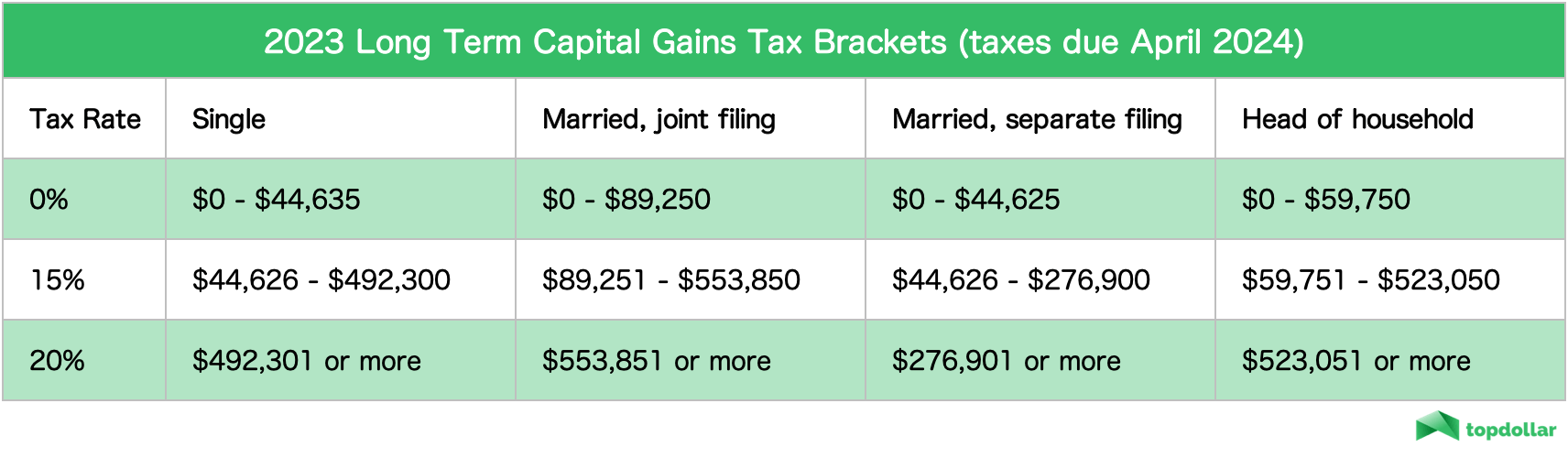

2023 Tax Rates & Federal Tax Brackets Top Dollar

What Is Capital Gains Tax Rate 2022 0%, 15%, or 20%, depending on your income. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. — capital gains tax rates are the same in 2024 as they were in 2023: The higher your income, the higher. — you earn a capital gain when you sell an investment or an asset for a profit. — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets. The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. 0%, 15%, or 20%, depending on your income. what is the capital gains tax rate for 2022? When you realize a capital gain, the proceeds are considered taxable.

From neswblogs.com

Capital Gains Tax Rate 2021 And 2022 Latest News Update What Is Capital Gains Tax Rate 2022 The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. The higher your income, the higher. what is the capital gains tax rate for 2022? — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates.. What Is Capital Gains Tax Rate 2022.

From sofiebjacquie.pages.dev

Current Long Term Capital Gains Tax Rate 2024 Lok Mead Stesha What Is Capital Gains Tax Rate 2022 When you realize a capital gain, the proceeds are considered taxable. 0%, 15%, or 20%, depending on your income. — you earn a capital gain when you sell an investment or an asset for a profit. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax. What Is Capital Gains Tax Rate 2022.

From faydravpamela.pages.dev

Long Term Capital Gains Tax Rate 2024 Uk 2024 Amber Bettina What Is Capital Gains Tax Rate 2022 — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. — you earn a capital gain when you sell an investment or an asset for a profit. what is the capital gains tax rate for 2022? — forbes advisor's capital gains tax calculator. What Is Capital Gains Tax Rate 2022.

From deeydiannne.pages.dev

Short Term Capital Gains Tax 2024 Chart Pdf Download Brigid Carolyn What Is Capital Gains Tax Rate 2022 When you realize a capital gain, the proceeds are considered taxable. 0%, 15%, or 20%, depending on your income. — capital gains tax rates are the same in 2024 as they were in 2023: — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets. what is. What Is Capital Gains Tax Rate 2022.

From www.financialsamurai.com

ShortTerm And LongTerm Capital Gains Tax Rates By What Is Capital Gains Tax Rate 2022 what is the capital gains tax rate for 2022? The higher your income, the higher. — capital gains tax rates are the same in 2024 as they were in 2023: — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets. The capital gains tax rate for. What Is Capital Gains Tax Rate 2022.

From wisevoter.com

Capital Gains Tax by State 2023 Wisevoter What Is Capital Gains Tax Rate 2022 — you earn a capital gain when you sell an investment or an asset for a profit. — capital gains tax rates are the same in 2024 as they were in 2023: The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. When you realize a capital gain,. What Is Capital Gains Tax Rate 2022.

From kateykynthia.pages.dev

Capital Gains Tax On Farmland 2025 Brita Marilin What Is Capital Gains Tax Rate 2022 — you earn a capital gain when you sell an investment or an asset for a profit. When you realize a capital gain, the proceeds are considered taxable. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. what is the capital gains tax. What Is Capital Gains Tax Rate 2022.

From natkavjacinta.pages.dev

Capital Gains Tax 2024/2024 2024 Calculator Lind Cherida What Is Capital Gains Tax Rate 2022 — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets. 0%, 15%, or 20%, depending on your income. The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. what is the capital gains tax rate for 2022?. What Is Capital Gains Tax Rate 2022.

From liesayhaleigh.pages.dev

Capital Gains Tax Rate 2024 South Africa 2024 Tildy Loella What Is Capital Gains Tax Rate 2022 — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. — you earn a capital gain when you sell an investment or an asset for a profit. The higher your income, the higher. what is the capital gains tax rate for 2022? 0%, 15%,. What Is Capital Gains Tax Rate 2022.

From bunnivvalentia.pages.dev

Capital Gains Tax Table 2025 Halie Philippine What Is Capital Gains Tax Rate 2022 — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. what is the capital gains tax rate for 2022? The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. When you realize a capital gain,. What Is Capital Gains Tax Rate 2022.

From topdollarinvestor.com

2023 Tax Rates & Federal Tax Brackets Top Dollar What Is Capital Gains Tax Rate 2022 — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. 0%, 15%, or 20%, depending on your income. what is the capital gains. What Is Capital Gains Tax Rate 2022.

From www.finansdirekt24.se

20212022 Capital Gains Tax Rates and How to Calculate Your Bill What Is Capital Gains Tax Rate 2022 — you earn a capital gain when you sell an investment or an asset for a profit. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. The capital gains tax rate for 2022 varies depending on your income level and the type of asset. What Is Capital Gains Tax Rate 2022.

From breeyrhianna.pages.dev

Capital Gain Tax Rate 2024 In Nepal Calculator Dena Zsazsa What Is Capital Gains Tax Rate 2022 When you realize a capital gain, the proceeds are considered taxable. 0%, 15%, or 20%, depending on your income. what is the capital gains tax rate for 2022? — you earn a capital gain when you sell an investment or an asset for a profit. — forbes advisor's capital gains tax calculator helps estimate the taxes you'll. What Is Capital Gains Tax Rate 2022.

From neswblogs.com

What Is Capital Gains Tax Rate 2022 Latest News Update What Is Capital Gains Tax Rate 2022 — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets. When you realize a capital gain, the proceeds are considered taxable. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. — capital. What Is Capital Gains Tax Rate 2022.

From realwealth.com

How to Calculate Capital Gains Tax on Real Estate Investment Property What Is Capital Gains Tax Rate 2022 When you realize a capital gain, the proceeds are considered taxable. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. — you earn a capital gain when you sell an investment or an asset for a profit. what is the capital gains tax. What Is Capital Gains Tax Rate 2022.

From taxcognition.com

Capital Gains Tax Worksheet 2022 Top FAQs of Tax Jan2023 What Is Capital Gains Tax Rate 2022 The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. what is the capital gains tax rate for 2022? — forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets. — learn more about capital gains taxes,. What Is Capital Gains Tax Rate 2022.

From celinabstafani.pages.dev

Capital Gains Tax 2024/2024 Holly Laureen What Is Capital Gains Tax Rate 2022 The capital gains tax rate for 2022 varies depending on your income level and the type of asset you sold. 0%, 15%, or 20%, depending on your income. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the capital gains tax rates. — forbes advisor's capital gains tax calculator. What Is Capital Gains Tax Rate 2022.

From burnsandwebber.designbyparent.co.uk

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns What Is Capital Gains Tax Rate 2022 — capital gains tax rates are the same in 2024 as they were in 2023: The higher your income, the higher. — you earn a capital gain when you sell an investment or an asset for a profit. — learn more about capital gains taxes, how capital gains will affect your taxes this year, and see the. What Is Capital Gains Tax Rate 2022.